That banking "work" changed significantly in the last decades is not a news. The times when (at least in Italy) young people dreamt of finding a job at a bank for the good pay and security of the job are long gone.

Tellers have mostly disappeared courtesy of ATM. However, tellers were just the front end to customers and many more people worked in the backstage (and still do). Now this is changing as well.

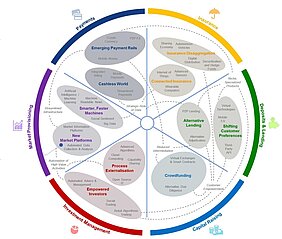

In a 2015 WEF report, on the future of financial services, the shift towards digital finance took the central stage.

It is not just about automation, as it was the case for the shift from tellers to ATM. It is about sw (applications) that can do the job of bankers "better"!

In the last few years the availability of huge, and diverse, amount of data and the development of analyses techniques (deep learning) has made possible the extraction of "meaning" out of data. The financial market floats on data and the digital transformation in all areas of economics is generating even more data. Their analyses is going beyond the capability of any single person and software has become the tool of the trade in finance.

JP Morgan has recently shifted the task of analysing commercial loan agreements from its lawyers to software. This is saving some 360,000 hours of work each year and providing results that are more accurate than the ones delivered by human workforce.

These analyses are actually providing even more data on what is happening and this, in turns, generates insights on the shift happening in the financial markets. It can also provide insights on the likely evolution of markets with obvious advantage to those making money out of market changes.

Last week in Brussels at the Partner Event we have seen a strong interest from EIT Digital Partnership to co-invest in the area of Digital Finance. Interestingly, it is an area where innovations happens "now"! In other areas, like Digital Industry or Digital Infrastructures, you are dealing with innovations that takes quite a bit of time to be deployed and to start having an impact. Not so in Digital Finance. This is a pure software area with very little legacy (although, of course it has to negotiate with the "standard" finance and its processes, with regulatory aspects....) and new deployments can occur in a blink of an eye and serve a global market.